Since Paris is a shopping paradise, how to receive a tax refund is something that visitors are concerned about. Here is the must-read manual for getting a tax refund when traveling in Europe.

- Stay in EU countries for less than 6 months, non-EU residents and over 16 years old, non-EU residents without long-term residence permits for EU countries.

- Spend more than a certain amount of money in the same shop (with TAX-FREE sign) on the same day, the minimum amount for the tax refund is different from country to country. For example, in France, you need to purchase over 100 euros (purchases made over 3 consecutive days) to get the tax refund, while in the Netherlands, the minimum amount is 50 euros.

- You must show your original passport or photocopy when purchasing, and you must conduct your tax refund and leave the EU within 90 days after the purchase. The two main tax refund companies are Premier Tax-Free and Global Blue.

- Ask the cashier to give you a tax refund form during checkout

- You can choose either a credit card refund or a cash refund. At airports, some shopping malls and shops can provide a cash refund on site. The credit cards tax rebate rate is higher than the cash refund rebate rate, but will take more time and can sometimes fail. Normally, a credit card refund tax rebate rate in France corresponds to 12%, but this rate is adjustable depending on the brand, while a cash refund rebate rate is slightly less (the rate varies in each country).

* Airport cash refund requires a service charge for each tax refund form, so we strongly advise you to buy all of your items at the same store and purchase them together.

* Minimum amount to spend to get tax refund:

France: 100 € (12% in average)

Italy: 154.95 € (11.6% - 15.5%)

Spain: 90.16 € (10.4% - 15.7%)

Germany: 25 € (6.1% - 14.5%)

UK: £30 (4.3% - 16.7%)

Netherlands: 50 € (7.8% to 15%)

Denmark: 300 DKK (11.8% to 17.5%)

Czech Republic: 2000 CZK (11.3% – 17.0%)

Belgium: 125.01 € (6%-21%)

Portugal: 53 €-61.5 € (6%-23%)

Austria: 75.01 € (up to 15%)

Hungary: 54001 HUF (13%-19%)

Croatia: 740 HRK (5%-25%)

Greece: 120 € (16%-23%) 50 € (24%)

Iceland: 6000 ISK (11% - 24%)

Ireland: 30 € (23%)

Poland: 200 PLN (5%-23%)

Russia: 10,000 RUB (up to 18%)

Malta: 100 € (11%)

Switzerland: 300 CHF (7.7%)

Norway: food 290 NOK (15%) / general goods 315 NOK (25%)

- When you do an on-site cash refund at some shops, you are required to leave the EU in 15 days (usually 21 days, but the tax refunder needs to stamp the tax refund forms and deliver them before leaving the EU, so a five-day tax refund time must be allotted).

- You must show either your passport, visa card, master card, or other international credit cards as guarantees to have your cash refund, otherwise, you will not be able to receive your money back. If the tax refund forms haven't been sent out in time, or the tax refund companies don't receive the tax refund forms in time, the tax refund company will deduct the tax on the credit card and add an extra 3% fine.

- The tax refund form must be sealed with the airport customs stamp and put into the airport mailbox.

- The money will be refunded within approximately 1-3 weeks after the tax refund companies receive your application form with the customs stamp after you leave Europe.

- Credit cards used for purchases and credit cards used for tax refunds can be the same or different.

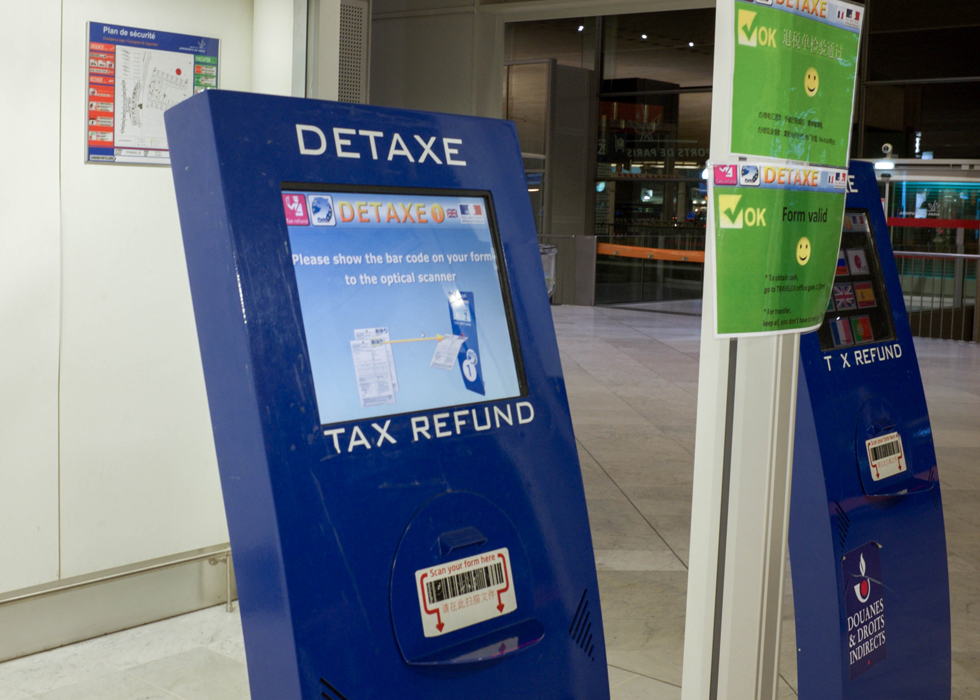

- To facilitate tax refunders, some European airports have tax refund machines. Take France for example, every tax refund form has a barcode, so all you have to do is find the tax refund machine, and scan the barcode. A smile on the machine screen proves a successful verification, and you don't need to queue up to get a custom seal. A crying face on the screen proves that was an unsuccessful verification, and you need to queue up to get the seal and then send the forms.

- Envelopes provided by merchants do not need to be stamped, and there is a postbox at the airport tax refund office.

- If you choose the cash payment tax refund, you don't need to send the materials.

- If you finally leave Europe from a non-EU country such as Switzerland, you have to get customs seals when you leave the EU countries and apply for a tax refund. If you arrive in Switzerland by train from an EU country, you can ask the staff on the train to get the seals from the train conductor. Similarly, if you take a boat or bus to leave an EU country, you must go to the tax refund point in the city for a cash rebate.

- It is recommended that you take a photo after you get the tax refund form and the customs scan or get the customs stamps. If there is any problem with the tax refund in the future, you at least have evidence of your tax refund procedure.

- The probability of an EU tax refund failure is not low. Likely, you can't have your refund. The airport cash rebate can be considered as a better option. The amount is small but you can get the refund immediately and successfully.

- If you plan to get the cash refund at the airport, it is better to arrive at the airport 4 hours earlier, otherwise, there are too many people and you may be late for your flight.

NOTICE

Duty-free products (including consumable items such as food, medicines, cosmetics, etc.) must be kept in good condition before leaving the EU country. They cannot be opened and used anytime during your travels. When leaving the EU countries, customs will check the purchase record on the passport and the duty-free goods (do not consign the goods before the customs inspection). If you don't obey the regulations, once it is discovered, you will have to make up the refunded tax.

1. Can I receive the tax refund at the last EU country before leaving Europe?

Yes. Remember that the UK is an EU country but Switzerland and Norway are not. Also, those who do the on-site cash tax refund should leave the EU in 15 days.

2. I am traveling in France, and will go to Switzerland afterward, can I have a tax refund in Switzerland?

No. Although Switzerland is a European country, it is not an EU country, and you cannot get a tax refund for things bought in France. If you are at the border, you can do it in France, but we strongly recommend you to do it at a French tax refund point.

3. Should I bring my passport and other documents when I do the on-site tax refund at shops? Can I use a passport photocopy?

You must bring your original passport. Although some stores accept photocopies, in French law, photocopies are not allowed to be used for a tax refund.

4. I am an international student studying in an EU country, can I have a tax refund? Or get a tax refund when I finish my studies and my student visa expires?

People holding a long-term residence visa cannot have a tax refund, so students studying in an EU country with a long-term residence visa cannot have a tax refund.

5. If I apply for a tax refund at the merchant's site, is the tax refund completed?

No. The tax refund forms given by the merchant must be taken to the airport tax refund office for machine scanning or customs stamping and sent on site. Please take a photo of each tax refund form in case you need to follow up in the future.

6. If the tax refund failed or did not reply, what should I do?

Take Premier Tax-Free as an example. Fill in the information on the official website or write a letter.

Website:http://premiertaxfree.com/track-my-refund-form

E-mail:[email protected]

7. When doing an on-site tax rebate at shops, does it mean that the tax refund is completed? What is the document that the merchant gave me?

No. Whether it is an on-site tax refund or not, you should always go to the customs office at the airport or tax refund point to scan the forms and get stamps. You must not miss this step. Otherwise, the tax refund will fail, and the refund tax, plus a fine will be deducted from the secured credit card.

- To bring great convenience and save your time on the trip, you can also download the ZappTax app and use it directly for a tax refund on your mobile phone. The ZappTax app can be used to process tax refunds for purchases made in France, the United Kingdom, Belgium, and Spain. More countries will be added to this list shortly.

- With ZappTax, not only can you save time at the airport, but you can also choose different refund methods (bank account, credit card, UnionPay card, Alipay, PayPal…). ZappTax will refund you in your local currency or the currency corresponding to your selected refund method (eg: Alipay = RMB, Thai credit card = Thai baht...)

- Get your VAT refund in 3 easy steps :

1. Make purchases at any store and request invoices with VAT. These invoices must be issued in the name of ZappTax. Take pictures of your invoices and upload them onto the ZappTax app.

2. ZappTax will email you your tax refund form. Print it (at your hotel for example...) before you leave for the airport or the border crossing. Get your tax-free from validated by Customs: at your final point of exit of the European Union, get your tax-free from validated by Customs (physical stamp or electronic bar-code scan). If your form was validated electronically (which is the case in France and Spain), you don’t need to do anything more. If your form was validated with a physical stamp, take a picture of your stamped tax-free form after validation and upload it onto the ZappTax app.

3. Refund will be processed within 24 hours after the validation of the tax-free form.

- ZappTax is simple, fast, and easy. It also provides one of the highest refunds on the market. And there is no minimum purchase threshold provided your total purchases in one country are above the local threshold (for example, if you make four purchases in four different stores in France and each of these purchases is worth € 50, then the total value of your purchases in France is € 200 and greater than the French threshold of € 175). The handling fee charged by ZappTax isis based on the total value of your purchases in a single country. . The higher the value, the lower the handling fee.

The most precious thing in travel is time, the traditional tax refund process will take a lot of your time because of the numerous cumbersome tax refund steps. You may be worried that you can’t complete all the steps. Don’t worry, you can download the ZappTax app. It will make your shopping trip easier and facilitate your tax refund experience.

When you register your app for the first time, you can get an additional € 5 refund by entering the code OBONPARIS at the time of registration. To benefit from this bonus, the total value of your purchases submitted to ZappTax must be over € 500 (including tax).

Words: O'bon Paris team

Photographs: Han Jaeun